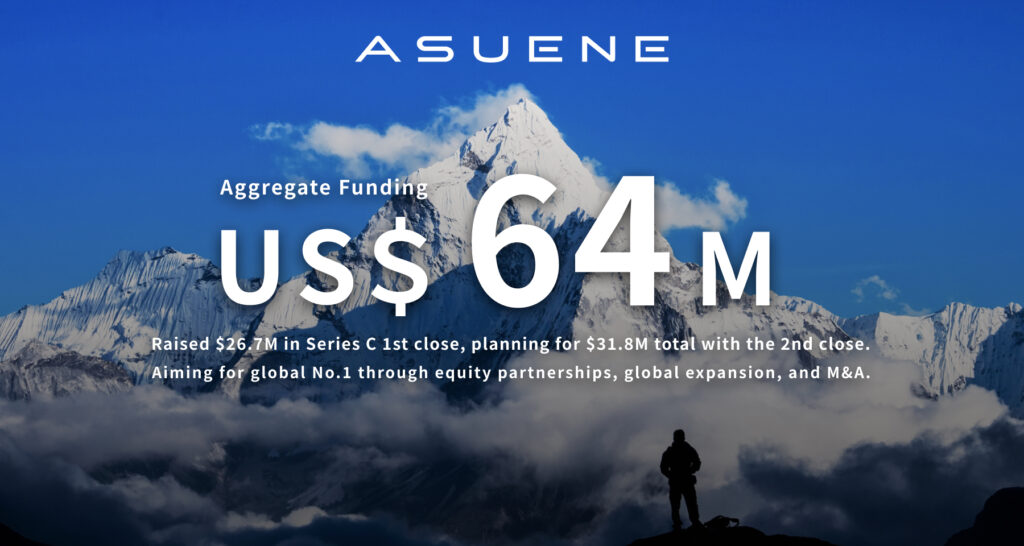

Asuene raises Total Funding of US $64 million in Series C 1st close Round, Targeting the top position globally through capital partnerships, global expansion, and M&A.

Asuene Inc., a compound startup in the climate tech sector, has successfully raised $26.7 million in the 1st close of its Series C round. This round is led by Sumitomo Mitsui Banking Corporation, SBI Investment, and Mirai Creation Fund III Invests managed by Sparx Asset Management. The funding involves third-party allotment to a total of 17 domestic and international investors, including existing shareholders. Asuene plans to raise a total of $31.8 million, including the upcoming 2nd close, bringing its cumulative funding to $64 million up to Series C.

Business Progress and Achievements

Asuene is advancing multiple products in the climate tech field, focusing on decarbonization and ESG.

The CO2 visualization, reduction, and reporting cloud service “ASUENE” has seen a rapid growth, with MRR orders increasing by 30 times compared to the Series B funding period. The number of client companies has surpassed 6,000, making it the leader in Japan, and the number of partner companies has exceeded 140. The ESG evaluation cloud “ASUENE ESG” has over 10,000 evaluated companies, promoting ESG management for many businesses. Additionally, the joint venture with SBI Holdings, “Carbon EX,” was established, launching a carbon credit exchange service, with over 1,000 companies registered on the platform.

With business expansion, the number of members has increased fivefold to 250. Asuene has established ASUENE APAC in Singapore and ASUENE USA in the United States, acquiring several dozen overseas customers and forming partnerships with numerous international partners. They have also set up a global development center in the Philippines, hiring many local engineers to drive global business growth.

Purpose of Funding and Future Prospects

The purpose of this funding round includes the following, as Asuene aims to become the number one climate tech company:

1. Aggressive recruitment of top talent (sales, marketing, development, new business development, M&A, etc.)

2. Expansion of sales and marketing through capital partnerships with major manufacturing companies

3. Technological investment and development team expansion for generative AI and LLM

4. Pursuit of non-linear growth through M&A

5. Strengthening global expansion in Asia, the United States, etc.

6. Further development of new businesses

Comment from a representative of Asuene

Given the unprecedented rise in global and domestic concern regarding climate change, the demand for Asuene’s innovative technology and outstanding services has surged. We are truly honored to have received investment from leading companies and investors both domestically and internationally. We extend our heartfelt gratitude to all stakeholders involved.

This round of funding marks a pivotal milestone for Asuene. It enables us not only to expand our operations in Japan but also to achieve significant growth through M&A, enhance our AI and LLM capabilities, and advance our global expansion under the ALL JAPAN strategy. We are excited to face these new challenges with our exceptional team, shareholders, and partners. Together, we will forge strong partnerships with companies, financial institutions, and stakeholders to achieve net-zero emissions. We are committed to boldly advancing our mission of “Changing the world for a better next generation.” and our vision of “Leading transformative change in the new generation.”