Policy, Price Signals, and Pragmatism: The Governance Behind Singapore’s Green Shift

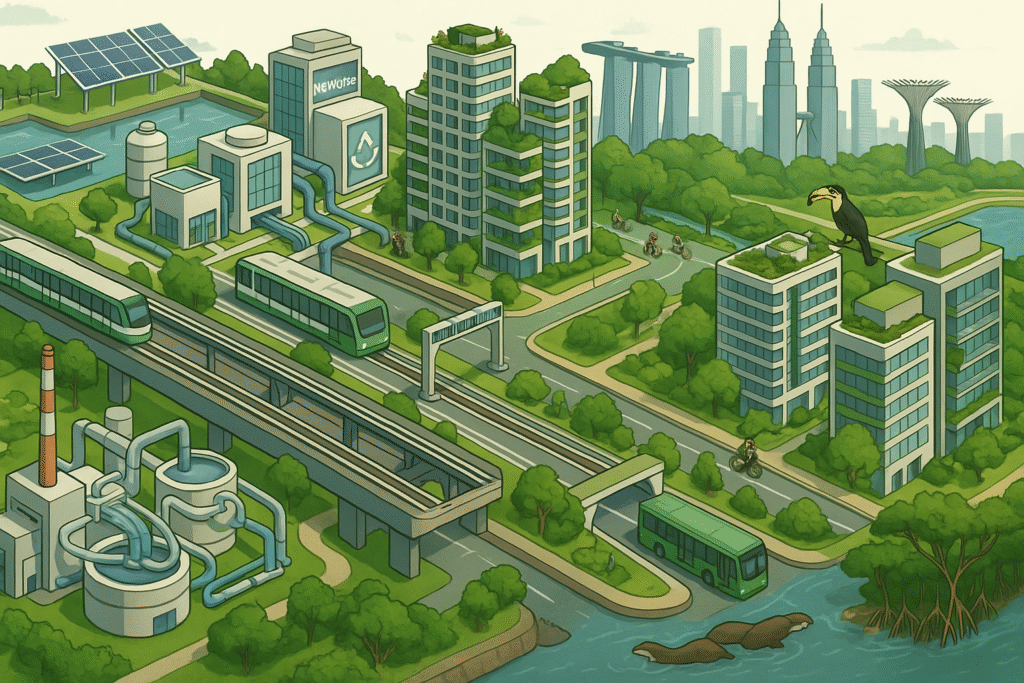

Singapore’s sustainability advances are often attributed to slick technology, but the quieter engine is governance: aligned agencies, predictable price signals, and a habit of scaling pilots only after evidence accumulates. This institutional choreography turns green aspirations into contracts, codes, and projects that endure electoral cycles.

Begin with carbon pricing. By putting a real cost on emissions, the carbon tax nudges industrial facilities to pursue measures that might otherwise sit in the too‑hard basket—heat integration, process electrification, and fuel switching. Because the price path is announced ahead of time, boards can model payback and time upgrades with plant maintenance turnarounds. The tax is complemented by grants and green finance so that firms can stack incentives and cut capital costs.

Regulatory clarity matters just as much. The Building and Construction Authority’s Green Mark scheme sets performance‑based criteria for energy use, indoor environmental quality, and, increasingly, embodied carbon. Developers can choose pathways that fit their site constraints, as long as outcomes are verified. On the energy side, market rules enable demand‑response and encourage storage, so businesses are rewarded for flexibility during peak demand.

Whole‑of‑government programs reduce silos. The Singapore Green Plan 2030 bundles targets for transport, energy, nature, and the green economy, aligning budgets and setting a common scoreboard. Agencies share data through geospatial platforms and digital twins, letting planners test how a new rail line, for example, might affect stormwater flows or tree shading before concrete is poured.

Procurement is wielded as a lever. Public projects increasingly specify lifecycle emissions thresholds, recycled content, or circularity requirements such as design for disassembly. When the state buys at scale, suppliers retool, and greener materials cross the price parity threshold faster. Disclosure rules for listed companies extend this logic to capital markets, making climate metrics part of routine investor due diligence.

The result is a feedback loop: price signals surface opportunities; regulations codify best practice; public spending de‑risks first movers; and data systems validate what works. This governance architecture is less glamorous than a new park or a gleaming solar array, but it explains why those assets appear on time and perform as promised. For cities seeking durable decarbonization, the lesson is clear—build the policy plumbing before turning on the taps.