Macro Strategy and Investment Flows: Mapping Malaysia’s Digital Flywheel

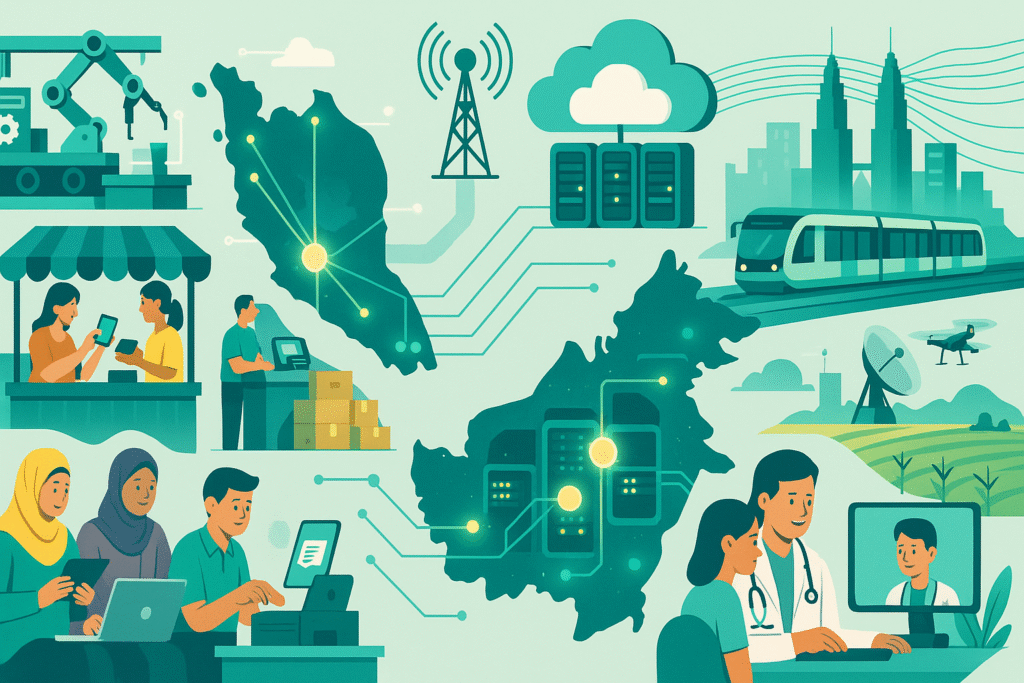

Malaysia’s digital economy is accelerating through a virtuous cycle that links infrastructure, capital, talent, and demand. The country has combined connectivity upgrades with a business-friendly environment to attract data-intensive industries—content delivery networks, cloud zones, and shared-service hubs. As these anchors grow, they generate downstream opportunities in cybersecurity, managed services, and software integration for local firms.

Connectivity remains foundational. Fiber backbones and carrier-neutral internet exchanges reduce latency and transit costs, while competitive spectrum policies support dense 4G and 5G deployments. Industrial clusters in Johor, Selangor, and Penang benefit from proximity to subsea cable landing points and a reliable power grid, making them natural homes for data centers and high-availability workloads.

Capital formation is the next gear in the flywheel. International investors bring scale and operational know-how, but domestic funds—pension managers, development finance institutions, and corporate venture arms—play a catalytic role in early-stage and growth rounds. This blend of patient and strategic capital helps local startups graduate from services to products, and from products to platforms that can scale across ASEAN.

Policy consistency matters as much as incentives. Clear, predictable rules on data protection, digital tax treatment, and cross-border data flows reduce uncertainty for exporters and cloud users. Streamlined permitting for facilities with large power and water footprints, combined with environmental standards, balances speed with stewardship and prevents infrastructure bottlenecks.

Enterprise demand creates a stable revenue base. Manufacturers modernize with IoT sensors and digital twins; banks and insurers expand mobile-first channels; logistics firms adopt route optimization and real-time tracking. Each adoption wave increases the installed base of software and systems integrators, strengthening the local vendor ecosystem and creating career paths for engineers and product managers.

Human capital is the compounding asset. Beyond coding, the market needs designers, data stewards, site reliability engineers, cybersecurity analysts, and product marketers. Apprenticeships, micro-credentials, and employer-led academies shorten the skill acquisition cycle, while regional talent mobility agreements help fill specialized roles in the short term.

Export orientation turns momentum into resilience. Malaysian firms that master compliance-heavy verticals—healthcare, halal supply chains, and financial services—can package those capabilities as software and consulting exports. Cross-border partnerships with platforms in Indonesia, Singapore, and Thailand allow companies to test regional product–market fit without setting up full-scale operations on day one.

Sustainability is now a competitiveness factor. Facilities adopt high-efficiency cooling, renewable power purchase agreements, and water recycling, while software teams measure and optimize the energy footprint of applications. Firms that can document low-carbon digital services gain access to global procurement pools with explicit environmental criteria.

Taken together, these elements form a flywheel: infrastructure attracts capital; capital funds capability; capability meets enterprise demand; demand signals attract more infrastructure. Malaysia’s task is to keep each spoke strong, ensuring the digital economy remains an engine of growth, diversification, and high-quality jobs.