UNAWA COO Atty. Gino Jacinto Talks Secure Digital Transactions at SPEED Event

UNAWA COO Atty. Gino Jacinto spoke at a SPEED event in Quezon City, organized by Startup Village. He discussed SME challenges in digital transitions and introduced SignSecure and UCheck for secure transactions and compliance. The event is part of a USAID initiative to enhance SME competitiveness and digital inclusion.

Quezon City, June 21, 2024—Startup Village organized and hosted an insightful session at the University Hotel in UP Diliman as part of the USAID-funded Strengthening Private Enterprises for the Digital Economy (SPEED) initiative. The event, which featured UNAWA COO Atty. Gino Jacinto, attracted

an audience primarily consisting of members from the Philippine Ecommerce

Association (PECA). Entrepreneurs were eager to enhance their businesses

through the latest technological innovations.

Atty. Jacinto’s talk, “SME Guide to Secure Digital Transactions and

Anti-Money Laundering,” focused on the critical challenges small and

medium-sized enterprises (SMEs) face as they transition to digital document

systems. He highlighted the necessity of upfront investments in technology and

training, which can be daunting for SMEs with limited resources. Additionally,

he discussed the complexity of navigating regulatory requirements without

dedicated legal or compliance teams.

Fresh from the success of UNAWA’s

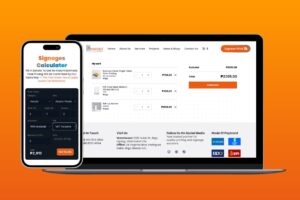

Freedom campaign, Atty. Jacinto introduced two groundbreaking tools: SignSecure

and UCheck.

SignSecure, which uniquely integrates facial recognition

into its e-signature platform, was a key highlight of the presentation. This

innovative feature ensures that the person signing the document is verified at

every step, a security measure unmatched by any other e-signature platform. “SignSecure enables businesses to close

deals securely and efficiently, eliminating doubts,” said Atty. Jacinto

emphasizing the platform’s enhanced security, legal enforceability, and

seamless transaction process.

Additionally, Atty. Jacinto unveiled UCheck, a

comprehensive solution that empowers businesses to make informed decisions and

protect against financial crimes. “UCheck offers robust protection against

financial crimes and ensures constant compliance with all regulations,” he

noted. By leveraging global sanctions lists, Politically Exposed Person (PEP)

checks, Adverse Media checks, and more, UCheck delivers the transparency

necessary for building trust and ensuring business security.

The event is part of a series under the USAID-funded SPEED initiative, which

aims to conduct 42 sessions nationwide involving at least 1,260 SMEs. The SPEED

Activity collaborates with the government and private sector to mobilize the

digital economy for enterprise-led development. The project’s key objectives

include improving SME capacity and access to e-commerce platforms, expanding e-payment

systems and FinTech innovations, integrating e-commerce platforms with

logistical supply chains, and increasing consumer awareness and protection.

By encouraging more SMEs to adopt digital technologies, the SPEED initiative

seeks to accelerate their competitiveness, drive innovation, create jobs, and

enhance market reach, thereby promoting inclusion in the digital economy.